Value creation

Nexus Infrastructure creates long-term sustainable organic growth and value for stakeholders.

Use the tabs below to find out more about how we create value

Our investment case

Strategically positioned to provide essential infrastructure solutions in critical sectors that are set for long-term growth

- Nexus’ strategic focus is on those sectors of critical infrastructure where chronic needs are the drivers for investment in the decades to come.

- These drivers are based on fundamentals such as climate change, environmental protection, shifts in social needs and improvements to energy security.

- Nexus provides solutions across a variety of sectors including housebuilding, water, rail, highways and rivers and marine.

Well placed for recovery of the chronic undersupply of housing in the UK

- A recovery in the housebuilding sector is inevitable as the country continues to face a chronic undersupply of good-quality affordable housing.

- A return to the long-term growth trend will bring a significant increase in demand for Tamdown’s services, at the leading edge of the market upturn.

Substantial investment is expected in other key sectors of UK national infrastructure

- Investment is to increase in several other key sectors of UK national infrastructure. For example, Ofwat’s final determination for the 2024 price review indicates that spending for the period 2025-2030 will be £104bn, a 71% increase in expenditure when compared to the previous five-year period price review.

High-quality customer relationships and expertise

- Extensive customer base developed during our 48-year heritage, the relationships we build and maintain with our customers are our day-to-day focus.

- We ensure the highest levels of customer service throughout all phases of our projects.

Experienced and loyal team

- The combination of our experienced Board and our highly skilled, motivated and loyal workforce supports our ongoing development and success.

- We work hard to ensure our people are recognised and engaged, and regularly undertake surveys and meetings to ensure feedback is kept up to date.

Robust balance sheet

- Civil engineering and construction businesses can face various risk factors.

- Having a strong balance sheet allows Nexus to both overcome challenges and take advantage of opportunities.

Commitment to sustainability

- Our purpose is ‘Building Bright Futures’ and, with this in mind, we consider our impact on all our stakeholders – from our people and supply chain through to society in general.

Market opportunity

Civil engineering solutions for sectors critical to the UK’s national infrastructure

Housebuilding sector

Through its subsidiary, Tamdown, Nexus provides infrastructure services to the housebuilding sector.

Market drivers

- The need for new housing is driven by population growth, changes in demographics and family groups

- Government target to deliver 1.5 million homes over the life of the current Parliament

- Inflation expected to stabilise during 2025, allowing interest rates to be further reduced, supporting new home sales

Opportunities

- Large-scale, complex, multi-phase housing developments requiring experienced infrastructure partners

Other sectors

The acquisition of Coleman Construction & Utilities Limited in October 2024, brings diversification into several key sectors including water, rail, highways, and rivers & marine.

Market drivers

- Public investment and government spending on infrastructure projects

- Climate change, improvements in environmental protection and shifts in societal needs

- Ageing infrastructure needing to be replaced with more sustainable solutions

Opportunities

- These sectors have multi-decade horizons and are less prone to short-term economic pressures

- Specialist construction services to the water sector by involvement in the water companies’ five-year Asset Management Plan (“AMP) periods

- Provision of safety-critical civil engineering services to the rail industry

- Civil engineering projects relating to the improvement of flood defences

- Government has approved five-year expenditure plans in several key sectors. Examples:

-

- Ofwat’s final determination for the 2024 price review indicated that spending for the period 2025-2030 will be £104bn, a 71% increase in expenditure when compared to the previous five-year period price review

- Office of Rail and Road (“ORR) final determination for PR23 approved Network Rail’s plans for spending £43.1bn during Control Period 7 (2024-2029)

Nexus’ mission is to be recognised as the leading provider of essential infrastructure solutions by delivering outstanding performance and customer satisfaction in sectors critical to UK national infrastructure.

Our strategic priorities

Growing with our customers

- Continual developments in the quality, features, and diversification of our offering

- Building and growing customer relationships, supported by high-quality service, competitive pricing, and a long-standing focus on health and safety

- Assuring and supporting customers delivering multi-phase, complex projects, using our extensive experience

Expanding our market

- Track record of identifying and investing in growing sectors and building go-to-market subsidiary operations

- Highly experienced Board and Executive team with extensive expertise across a range of infrastructure sectors

- Securing opportunities across new projects and sectors, and delivering innovative services

Focus on financial delivery

- Improving the level and consistency of operating margins

- Investing resources to improve productivity and enable growth

- Managing overheads and discretionary spend, while maintaining tight control of cash

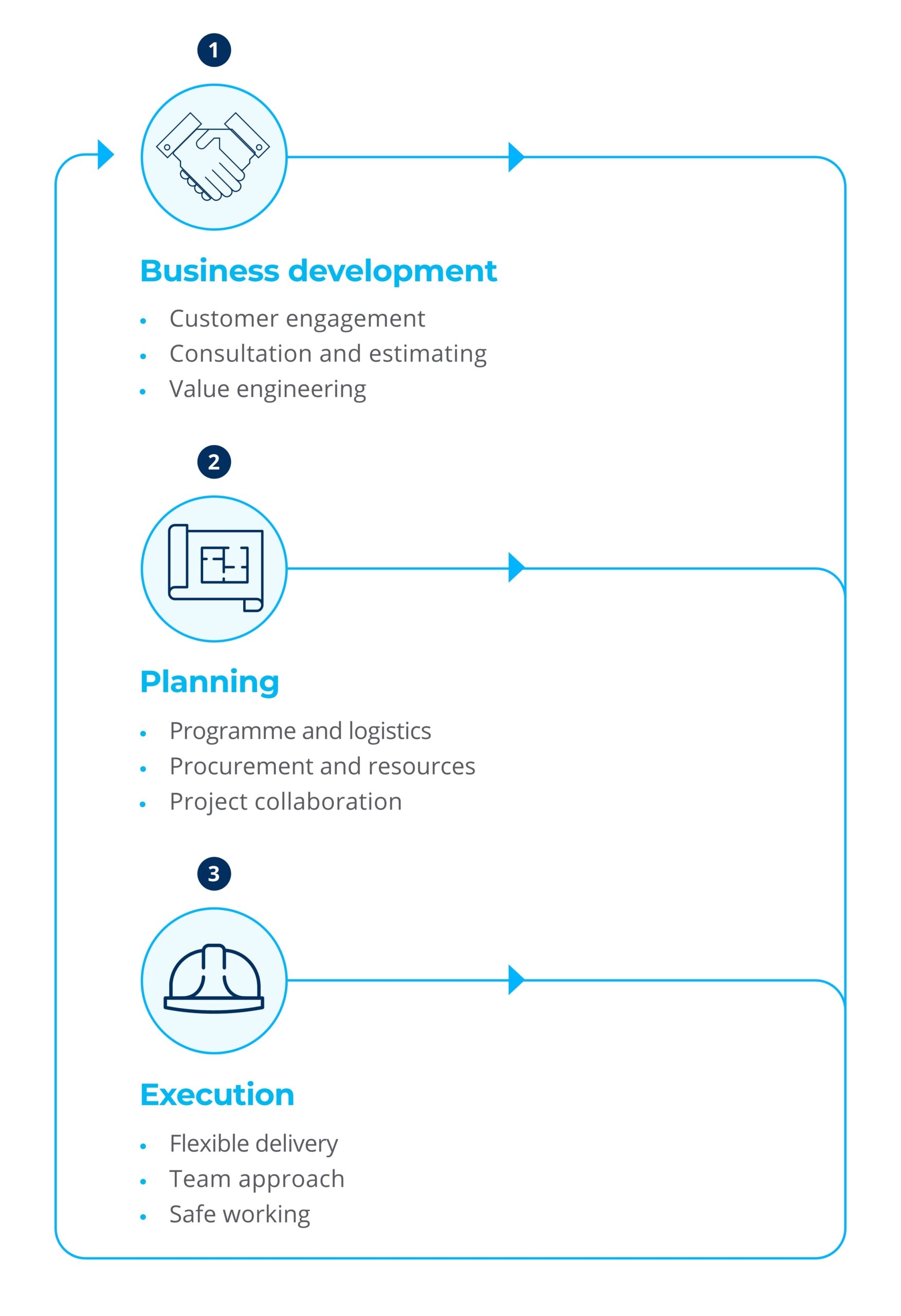

Our business model

The resources and relationships we need to run our business:

Our people

Highly skilled, motivated and loyal workforce. Experienced senior management team and Board.

Markets

Focus on sectors key to UK national infrastructure.

Financials

A strong balance sheet provides resilience and sustainability.

Business development

Customer engagement

Consultation and estimating

Value engineering

Planning

Programme and logistics

Procurement and resources

Project collaboration

Execution

Flexible delivery

Team approach

Safe working

Our shareholders

Committed to enabling a progressive dividend policy during challenging market condition periods.

Our customers

Relationships, partnerships and effective engagement with our customers to understand their individual challenges and needs.

Our people

Group purpose and values with a strong focus on staff development and learning as well as health, safety and wellbeing.

Our communities

Financial support to charities, staff volunteering days, supporting educational organisations and pupils, and more.

Safety and sustainability

Our fundamental goal is that everyone goes home safely at the end of every day. The health, safety and wellbeing of our people is at the forefront of everything we do, supported by safety campaigns, training and wellbeing initiatives. Taking care of our environment, while providing essential infrastructure solutions, is core to our approach.

Customer service

Our customers choose us because we are dedicated to quality delivery and take the time to fully understand their project objectives. We ensure all our teams are customer focused during the consultation, procurement, and delivery stages. We provide follow-up to all our projects and are passionate about customer satisfaction.

Best solutions

Through our close relationships with our customers, we work in partnership to develop the right solutions to any potential problems. Our teams will always challenge assumptions and wherever possible find a better way to deliver the best solutions for our customers’ projects.

KPIs

The Board uses key performance indicators to measure its progress against the Group’s strategic objectives.

- Revenue and revenue growth track our performance against our strategic aim to grow the Group through supporting our customers and expanding our markets

| 2024: | 56.7 |

| 2023: | 88.7 |

| 2022: | 98.4 |

- Tracking gross profit ensures that the focus remains on delivering profitable outcomes on our contracts

| 2024: | 7.7 |

| 2023: | 5.9 |

| 2022: | 9.9 |

- Tracking of the operating loss demonstrates the improvement in both gross profit and reduction in overheads

| 2024: | (2.2) |

| 2023: | (8.4) |

| 2022: | (0.3) |

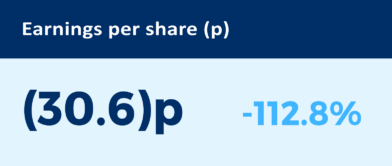

- Tracking the after-tax earnings relative to the average number of shares in issue provides a monitor on shareholder value

| 2024: | (30.6) |

| 2023: | 239.0 |

| 2022: | 6.0 |

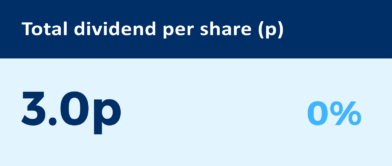

- Tracking the total dividend per share declared for each financial year provides a monitor on the return achieved for shareholders

| 2024: | 3.0 |

| 2023: | 3.0 |

| 2022: | 1.0 |

- Tracking the cash balance monitors the conversion of profits into cash, ensuring that cash is available for reinvestment and supporting delivery of the strategy

| 2024: | 12.8 |

| 2023: | 14.6 |

| 2022: | 4.6 |

- Tracking the Group’s net assets monitors the Group’s financial strength and stability

| 2024: | 30.0 |

| 2023: | 33.0 |

| 2022: | 34.1 |

- Tracking of the order book, being the amount of secured work yet to be recorded as revenue provides visibility on expected future revenue against the strategic aim to grow the business

| 2024: | 51.6 |

| 2023: | 46.0 |

| 2022: | 95.5 |